WHY CREATE YOUR COMPANY IN IRELAND?

>>> Leggi questa pagina in italiano >>> >>> Lea esta página en español >>>

-

The new 2014 law in Ireland makes it easier for managers to manage a company. The goal of the Irish government is to make Ireland the easiest place in the world to do business.

-

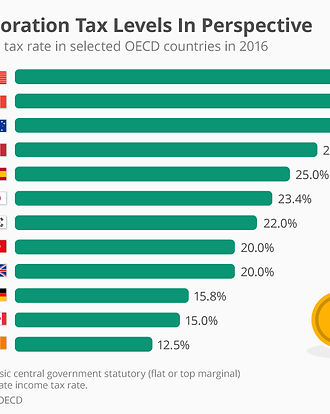

Ireland has a low corporate tax rate of 12.5% and is a professional business environment.

-

Low equity capital requirement, starting at € 100

-

There is limited liability for shareholders. Shareholders only risk the equity capital they invest.

-

Ireland is an English speaking jurisdiction, the only one in the euro area.

-

Ireland offers free access to over 500 million consumers in Europe.

-

Ireland is ranked among the top 10 easiest places in the world to do business.

-

There are generous tax credits for research and development.

-

A company is a legal entity in itself. It is completely separate from the officers and people who run it. For example, it is the company that is taking legal action following unpaid debts.

-

A limited liability company has a greater ability to raise finance through the issue of shares.

-

The name of the limited liability company is protected.

-

The company is protected from sudden changes to the management structure.

-

Employees can acquire shares in the company.

-

Making changes to society is relatively simple.

TAXES

Directors pay income tax and the company pays corporate tax on corporate profits, and with current tax rates, company profits earned and retained in the business are valued at corporate tax with lower rates than tax on income paid on equivalent profits earned by an unregistered firm

Scope of application for a higher corporate pension scheme to be guaranteed through a limited liability company

Personal tax benefits can accrue for directors of a limited liability company

Company tax comparison chart

Maximize the tax benefits of a limited liability company

One of the main objectives for small businesses will be to maximize the benefits to minimize taxes. This can be done by:

-

Ensure that your company contributes to retirement (if cash flow permits)

-

Request the maximum costs allowed by the legislation

-

The capital equipment used in your business is purchased and the capital requests required

-

Ensure that benefits in kind (insurance, health care, etc.) are paid for by the company

CREA LTD IN IRLANDA

PACCHETTO BASE

Maximize the tax benefits of a limited liability company

We create your LTD based in Ireland, in five days.

-

The basic package includes:

-

Incorporation of the company with the name of your choice;

-

Registered office in Dublin or Cork, for the first year

-

Certificate of incorporation (pdf document via email);

-

Certificate of ownership (pdf document via email)

-

Memorandum and articles (pdf document via email)

-

Cost: € 750

BUILD LTD IN IRELAND

BANK PACKAGE

We create your LTD based in Ireland, in five days.

The Bank package includes:

-

Incorporation of the company with the name of your choice;

-

Registered office in Dublin or Cork, for the first year

-

Certificate of incorporation (pdf document via email);

-

Certificate of ownership (pdf document via email)

-

Memorandum and articles (pdf document via email)

-

Bank Current Account at Bank of Ireland

-

Cost: € 1,500

BUILD LTD IN IRELAND

MANAGER PACKAGE

We create your LTD based in Ireland, in five days.

The Manager package includes:

-

Incorporation of the company with the name of your choice;

-

Registered office in Dublin or Cork, for the first year

-

Certificate of incorporation (pdf document via email);

-

Certificate of ownership (pdf document via email)

-

Memorandum and articles (pdf document via email)

-

Nominee Secretary or a Nominee Director of your choice

-

Cost: € 2,500 for the first year. - € 2,000 the following years

BUILT LTD IN IRELAND

GOVERNANCE PACKAGE

We create your LTD based in Ireland, in three days.

The Governance package includes:

-

Incorporation of the company with the name of your choice;

-

Registered office in Dublin or Cork, for the first year

-

Certificate of incorporation (pdf document via email);

-

Certificate of ownership (pdf document via email)

-

Memorandum and articles (pdf document via email)

-

Nominee Secretary and a Nominee Director

-

Cost: € 5,500 for the first year. - € 5,000 the following years

BUILT LTD IN IRELAND

PROFESSIONAL PACKAGE

We create your LTD based in Ireland, in five days.

The Professional package includes:

-

Incorporation of the company with the name of your choice;

-

Registered office in London, for the first year

-

Certificate of incorporation (pdf document via email);

-

Certificate of ownership (pdf document via email)

-

Memorandum and articles (pdf document via email)

-

Nominee Secretary and a Nominee Director

-

Bank Current Account at Barclays or Lloyds

-

Cost: € 6,500 for the first year. - € 5,000 the following years

CREATE YOUR COMPANY AROUND THE WORLD

Thanks to our global partner network, we are able to create your company anywhere in the world.